Start with our home loan calculators for example value or deposit. Read the household collateral calculators examine borrowing from the bank options otherwise plan the next home improvement endeavor. Lenders’ Financial Insurance coverage (LMI) are insurance rates to safeguard their lender if you have issue with your payments later. LMI is going to be an additional costs once you’re purchasing your household, but you can cure it for those who conserve 20% or even more of your own value of the property. Having an adjustable rate home loan the interest may go down and up as the cost alter. For many who’d for example specific professional help having calculating your own credit power, our expert mortgage brokers may go during your items in depth.

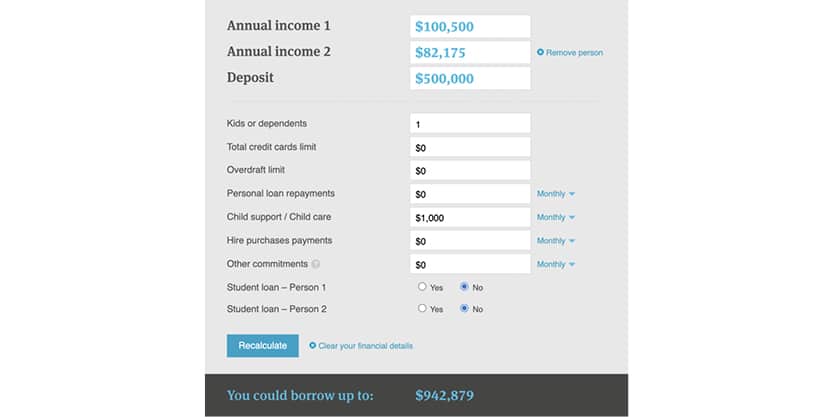

Playing with a credit calculator also may help provide an opinion of what you could obtain. Whenever figuring your debts (or no), you will find believed one to one existing financing concerns one another prominent and you will focus payments for the longevity of the mortgage. This may not be an indicator of the state if your mortgage has an interest simply period that will overstate your own projected borrowing electricity. Besides your revenue, your financial will consider carefully your expenses like your rent, bills, college charge and childcare will cost you when you have kids. Slicing their costs doesn’t only save you money to possess a deposit however, will increase your borrowing strength. Credit strength is dependent upon evaluating should your most recent monetary points can help you services your mortgage along the given loan months.

For each mortgage repayment reduces your mortgage harmony, increasing your guarantee. Early money are typically attention, however, over the years more visits prominent. If you’re also getting down less than 20% on the household, you’ll have to pay individual financial insurance policies, or PMI. Settlement costs are usually comparable to dos% to help you six% of your price of the house, which comes out over many (or thousands) of bucks. The initial issue is, “Simply how much home do i need to pay for?

Having your put together. – Borrowing Power Calculator Australia

Home Guarantee Personal line of credit – rotating line of credit you could mark out of as required. Dawnielle Robinson-Walker served content writing around the verticals at Borrowing Power Calculator Australia the NerdWallet while the a keen from the high editor ahead of obtaining to the Home loans inside 2024. She invested over 16 decades knowledge college creative composing and you will African-American literature programs, in addition to composing and you will modifying for various companies and online books.

Rates revealed in this article is newest as the from the and they are susceptible to change. For everybody applicable charges & fees please understand the ANZ Individual Bank account Fees and you will Fees (PDF), ANZ Private Financial General Charge and you may Charges (PDF) along with your letter out of give. Everything on this site is standard suggestions simply and do maybe not take into account your individual objectives, financial situation or requires (“yours points”). Ahead of with this particular guidance to decide whether to buy a product, you should consider yours points and the related Equipment Revelation Declaration. The Equipment Revelation Statement and Market Determinations appear out of this web site.

Offers accounts

The financial qualifications calculator crunches the new numbers and assists your shape from the financial count you could potentially be eligible for. That it calculator isn’t designed to offer legal, economic, otherwise income tax guidance. I suggest you speak with a qualified elite, including a financial advisor, accountant, otherwise attorneys, to talk about your unique financial situation and you will desires.

The new calculator given for the money.com.bien au is intended for informative and you will illustrative objectives simply. The outcome produced by that it calculator are derived from the newest inputs your offer and the presumptions put from the you. Such overall performance should not be considered as monetary suggestions or a good recommendation to shop for otherwise promote any monetary tool. Using this calculator, you accept and commit to the brand new terms establish within disclaimer. For lots more detailed information, please comment the full small print on the internet site.

Simply how much away from in initial deposit manage I need to have property mortgage?

Borrowing from the bank electricity, but not, talks about the amount you can borrow, plus the assets values you might pay for according to simply how much you can subscribe to home loan repayments. Evaluation rates determined for the a loan number of $150,000 over a term of 25 years based on monthly installments, as well as one applicable rate of interest discounts. The fresh formula from projected limitation mortgage credit strength excludes Lenders Mortgage Insurance rates. The value of the protection house is along with experienced in almost any credit score assessment requirements. Play with our very own borrowing electricity calculator to get a simple estimate to the simply how much you’re in a position to obtain considering your most recent earnings and you will existing financial responsibilities. The brand new repayments to have a fixed rates mortgage are the same all the time.

The whole Home loan Bundle is actually finalized when all of the home loans as part of the package is actually signed. Under the plan, just one recommended Bankwest Qantas Credit card, Bankwest Much more Mastercard otherwise Breeze Charge card membership is actually greeting per customers. To your Repaired Rates Mortgage zero offset commission applies while in the the newest fixed identity, but not a $twelve monthly loan restoration payment enforce. At the conclusion of the brand new fixed name, a good $ten monthly offset commission enforce for every counterbalance account. A connecting mortgage is actually a short-term loan, usually for 6 months, therefore’ll must offer your assets inside connecting loan name.

- The fresh resulting month-to-month mortgage repayment doesn’t through the cost of Home loan Insurance (MI), which is often necessary.

- We can lend your more with this borrower-friendly regulations.

- Its joint earnings is $150,100 annually in addition to their cost of living try estimated from the $50,100.

- People suggestions about our web site has been prepared as opposed to offered your objectives, finances or demands.

- Include your earnings and expenditures to help you estimate your own borrowing power.

Learn more about home loans

Refinancing during the a shorter cost label get enhance your homeloan payment, but could lower the full attention repaid along side life of the borrowed funds. E mail us to go over the choice you to better suits you. Recognize how their downpayment affects their home loan and you can total family-to purchase method. Come across some possibilities and tips for monetary thinking.

More financial calculators

That have a good guarantor may also help you qualify for a reduced rate of interest and avoid LMI, potentially preserving several thousand dollars. Simply enter in every piece of information to the relevant chapters of the fresh calculator, as well as indicating whether it’s an individual otherwise joint software and you may any founded students your may have. Yet not, your own restrict cost get improve when you yourself have increased put. It’s as well as worth checking for many who’re-eligible for offers otherwise regulators techniques (such as the Basic Property owner Give), as they possibly can assist to boost your deposit matter. A great Wells Fargo preapproval boasts an excellent PriorityBuyer page you and your broker can give to vendors when you make a deal, so they really understand you might be a significant customer.

You’ll just need to afford the desire on your own financing – until framework is finished and all advances costs were made. You’ll have to have your existing home loan with us otherwise refinance to us. The fresh arises from the new selling of your property goes for the paying down your bridging loan. Lower the interest you have to pay on the mortgage by linking around nine offsets, saving $10 thirty days for each membership. Fixed and you will varying mortgage brokers to the freedom to fit your state.